Endorsing a check is something that needs to be done in order to ensure that the check can be cashed or deposited. However, does it matter whether you endorse the check with cursive or not? Let's take a look to see if this is an important factor.

If the bank allows the check to be deposited without a cursive signature, then it is not necessary to sign the check in cursive. However, if the bank requires a cursive signature in order to match the signature on file, then it is necessary to sign the check in cursive. If you are not sure whether or not your bank requires a cursive signature, it is best to err on the side of caution and sign the check in cursive.

Understanding how to sign a check is important, whether you are signing it in cursive or not. In this article, we will discuss why it may be required to endorse a check in cursive. In addition, we will answer other frequently asked questions about writing and signing checks, so let's get to it!

Do You Have To Endorse A Check In Cursive?

When someone writes a check to you, they will include your name on the "Pay to the Order Of" line. This is who the check is written out to, and you are the only person who can deposit or cash the check. In order to endorse a check, you simply need to sign your name on the back of the check.

However, it is at your bank's discretion whether or not they will require a cursive signature. If your bank does not require a cursive signature, then you can simply sign your name in print.

For example, if you have a long-lasting membership with your bank, then they may have your signature on file from when you opened the account. In this case, they will likely not require a cursive signature when you endorse the check.

On the other hand, if you recently opened an account or do not have a long-standing relationship with your bank, they may require a cursive signature so they can verify that it is really you who is endorsing the check.

In short, whether or not you need to endorse a check in cursive depends on your bank's policies. However, if you are unsure, it is always best to err on the side of caution and sign the check in cursive.

In addition, you can ask the teller at your bank whether or not they require a cursive signature when you endorse a check.

Can You Endorse A Check With A Stamp?

If you own a business, then it's not a bad idea to get a rubber stamp of your signature. This can come in handy if you need to endorse a check but don't have time to sign it yourself.

In addition, if you receive several checks a day, it may be more efficient to stamp them rather than signing each one individually. However, you should check with your bank to make sure that they will accept a stamped signature before using this method.

Typically, if you have a business where the bank is aware that you will be using a stamp to sign checks, then they will likely not have any problem with it. However, if you try to deposit a check that has been stamped without the bank's knowledge, they may reject it.

In short, you can endorse a check with a stamp as long as your bank is aware of and approves of this method.

How Do You Sign A Check Over To Someone Else?

If you need to sign a check over to someone else, you will need to endorse the check first. To do this, simply sign your name on the signature line of the check.

Then, on the line below your signature, write "Pay to the order of," followed by the name of the person you are signing the check over to.

For example, if you are signing a check over to your friend John, you would write "Pay to the order of John" on the line below your signature. Once you have done this, John can take the check to his bank and cash it or deposit it into his account.

This can come in handy if you don't have time to cash a check yourself and need to give it to someone else to do it for you. Just be sure that you trust the person you are signing the check over to, as they will have full access to the funds once they endorse it.

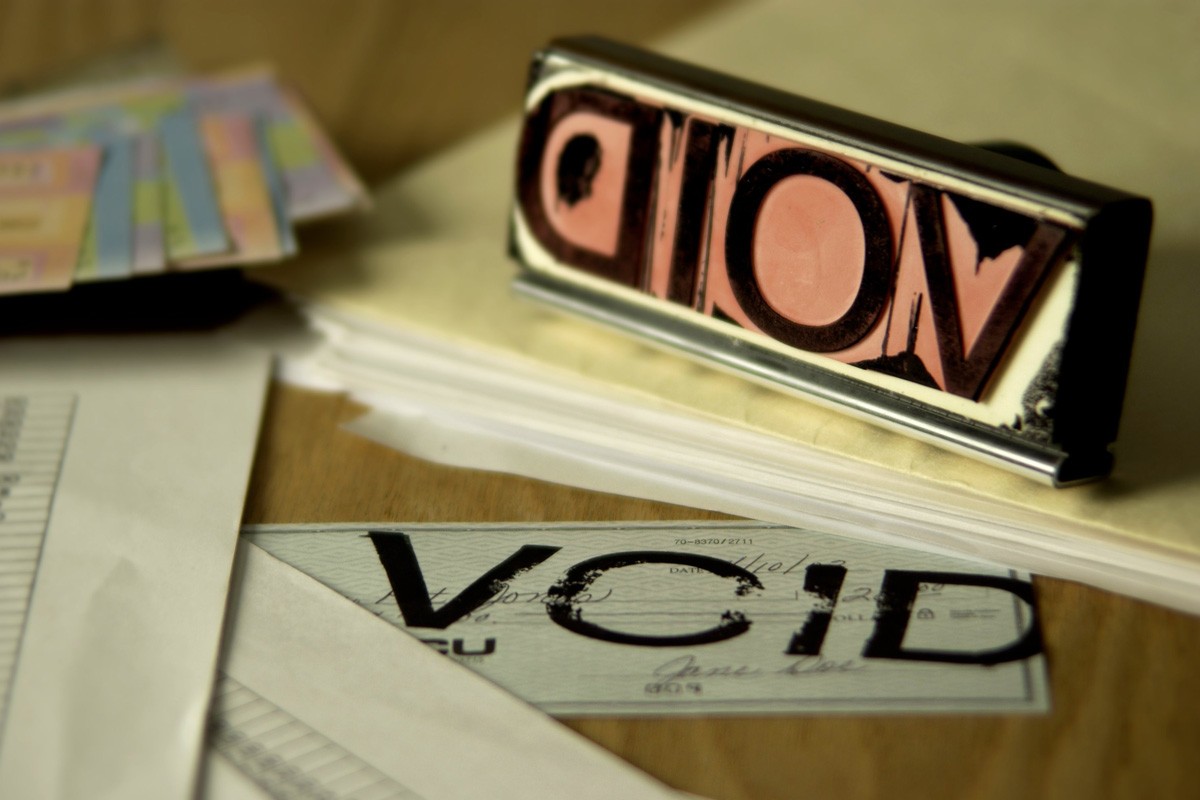

How Do You Void A Check?

If, for some reason, you need to void a check, simply write the word "Void" across the face of the check. Once you have done this, the check can no longer be used.

This may be necessary if you write a check and then realize that you made a mistake. For example, if you wrote the wrong amount or date on the check, you will need to void it and start over.

If you have given someone a check that you accidentally wrote the wrong amount on, you can ask them to return the check to you so that you can void it. However, if they have already deposited the check, you will need to contact your bank and ask them to cancel the transaction.

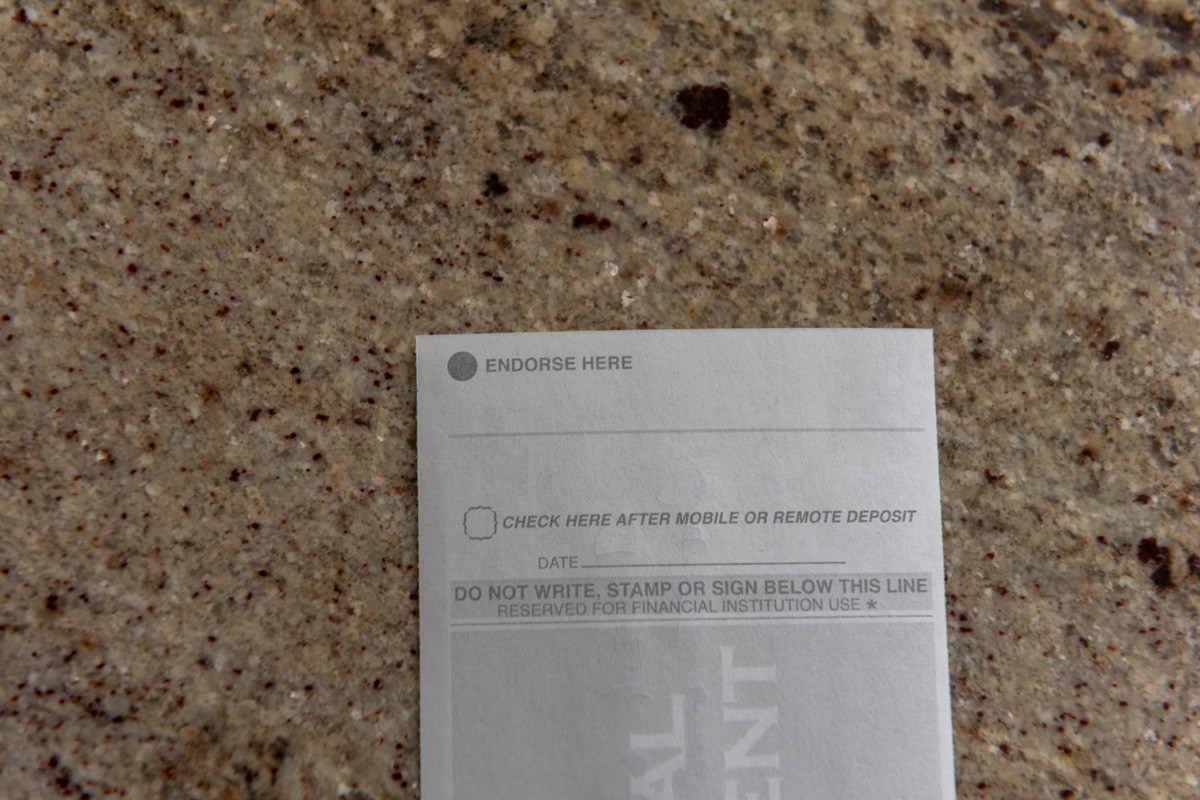

How Do I Endorse A Check For Mobile Deposit?

So, since we are living in a technology-driven world, you may be wondering if there is a way to deposit a check without having to physically go to the bank.

The answer is yes! Many banks now offer a mobile deposit option, which allows you to deposit checks directly from your smartphone or tablet.

To do this, simply download your bank's mobile app and follow the instructions. You will typically need to take a photo of the front and back of the check and then submit it for deposit.

However, you need to endorse the check by writing "For Mobile Deposit Only" under the signature line. This lets your bank know that you are aware of the fact that the check will be deposited electronically and that you agree to the terms.

If you don't endorse the check for mobile deposit, your bank may reject it.

What Is The Largest Check A Bank Will Cash?

There isn't a specific limit on the amount of money that you can cash at a bank. However, banks may have their own policies in place regarding how much money they are willing to dispense at one time.

In addition, any check over $10,000 is required to report to the IRS. So, if you are looking to cash a check for a large amount of money, you may need to do it in multiple transactions or at different banks.

You can also speak to your bank in advance to see if they have any limits in place on how much money you can cash at one time.

Do Banks Verify Checks Before Cashing Them?

Banks do need to verify checks before cashing them for a couple of reasons. First off, checks actually don't have a monetary value when they are first written.

Instead, the bank that the check is drawn on essentially promises to pay the amount of the check to whoever it is made out to. So, when you cash a check at your bank, your bank is basically trusting that the other bank will honor its promise and pay them back.

Secondly, banks need to verify that the check is legitimate and that it hasn't been altered in any way. This is why you will often see bank tellers comparing the signature on the check to the one on file.

For example, scammers will sometimes try to change the amount of money on a check or alter the payee's name. So, banks need to verify that the check is valid before they can cash it.

What Happens If I Cash A Bad Check?

If you cash a bad check, it essentially means that you have accepted a check that cannot be honored by the bank. This can happen for a number of reasons, such as if the account has been closed or if there are insufficient funds to cover the amount of the check.

If you cash a bad check, you will be responsible for repaying the amount of money to the bank. In addition, the bank may charge you a fee for depositing the check.

Furthermore, if you knowingly cash a bad check, you could be charged with bank fraud, which is a federal crime.

So, it's always best to verify that a check is good before you try to cash it. You can do this by asking the person who wrote the check for their ID and then calling the bank to verify that the check is genuine.

Final Thoughts

While checks are becoming less common due to the rise of electronic payments, there are still times when you may need to cash one.

Just be sure to endorse the check correctly and to call the bank in advance to verify that the check is good. This will help ensure that you don't run into any problems when trying to cash a check at your bank.

Made it to the end? Here are other articles you might find helpful:

Can You Deposit A Check For Someone Else Into Their Account?