Buying a car can be a complicated process, not to mention expensive. Making the process as least complicated as possible should be a given to help ease the burden of buying such a significant asset. Car loan calculators help you figure out how much of a monthly payment you can afford so you can feel confident when you drive off the lot. We've broken down the best online car loan calculators to help you have financial peace when purchasing your new car.

These are the most accurate, detailed, and user-friendly car loan calculators:

Each of these auto loan calculators balances ease-of-use with helpful information.

Continue reading further as we explain car loan calculators and go over each of the best calculators in greater detail.

What Is A Car Loan Calculator? How Does It Work?

A car loan may seem intimidating at first because of all the variables. But calculators make it pretty simple. Car loan calculators take the price of the new car, your down payment, interest rate, your trade-in value, the term, and other details to give you an estimate on what your monthly payment will be. The monthly payment is generally the point of a car loan calculator. You are plugging in all the numbers to see if you will be able to afford the car's monthly payments.

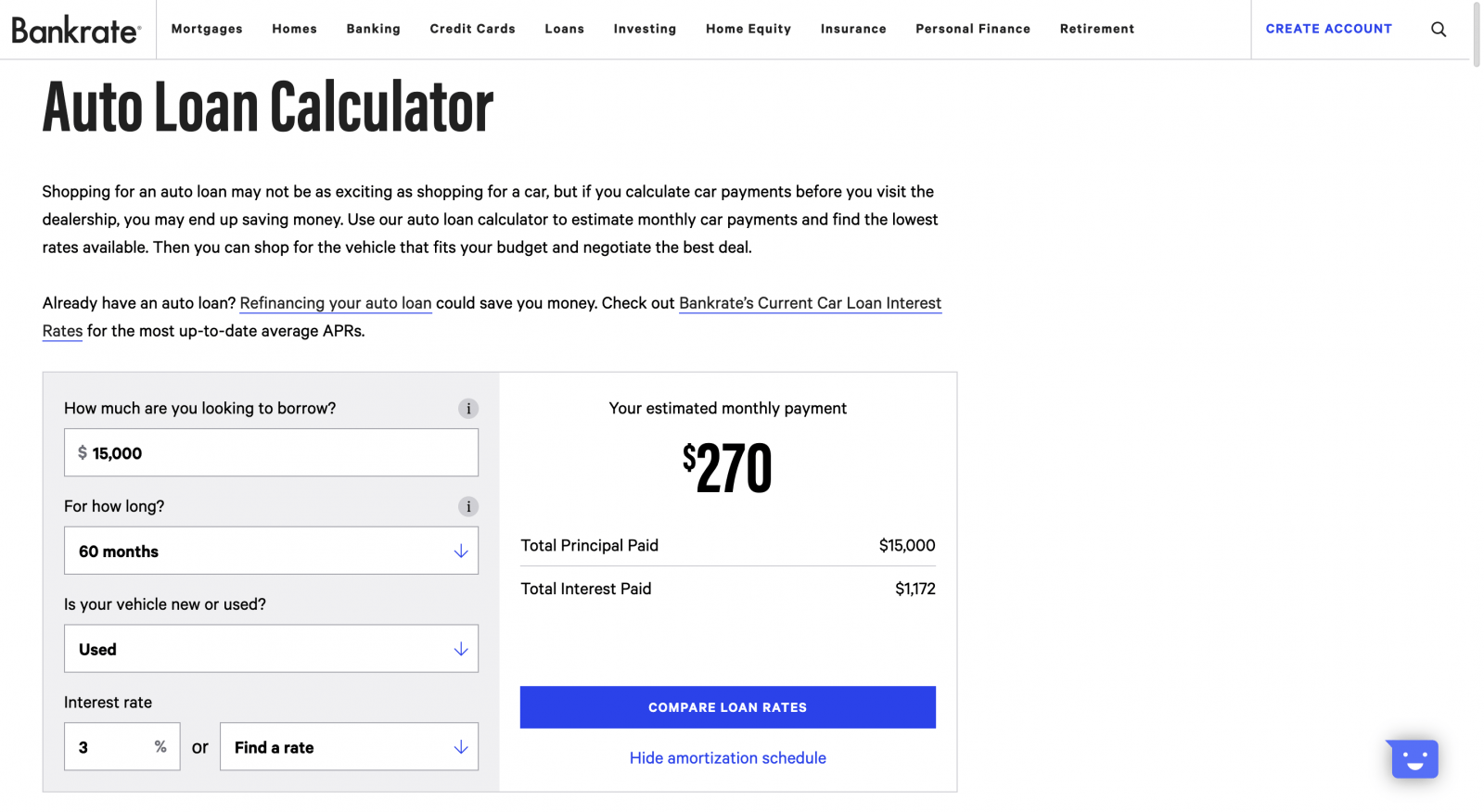

Calculate Stuff

Calculate Stuff is possibly one of the most thorough auto loan calculators on the web. What it lacks in looks, it makes up for in information. Not only does it take the obvious information like the cost of the car, down payment, interest rate, etc., but it also allows you to enter in less basic details like what you owe on your trade-in and the sales tax rate on the new car.

But wait, there's more! It also gives you the total interest rate you'll pay based on what you entered, and an amortization schedule to detail it. Calculate Stuff's website is full of different types of calculators. Their mastery of calculators is apparent. They don't cut any corners on their car loan calculator; it's a great tool.

Cars.com

Cars.com is one of the most popular websites to look for new and used cars. It's no wonder they also have a great auto loan calculator. What makes this calculator special is its ability to take the information you entered to get your desired monthly payment and immediately search for cars in your price range on their expansive website. It's an intuitive and well-designed calculator. With all its features and plenty of options to utilize, it is well worth taking a look at to calculate your next auto loan payment.

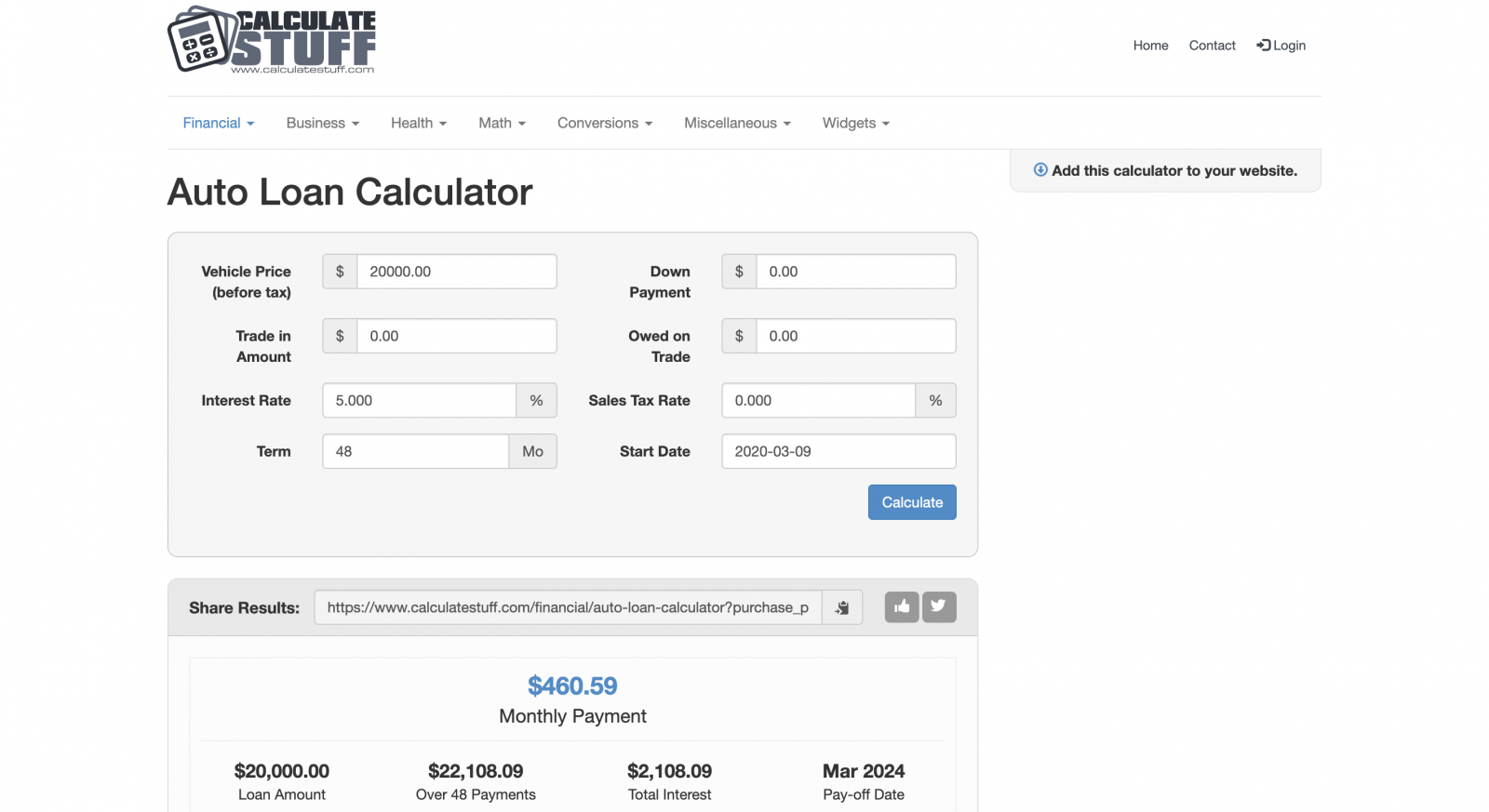

Calculator.net

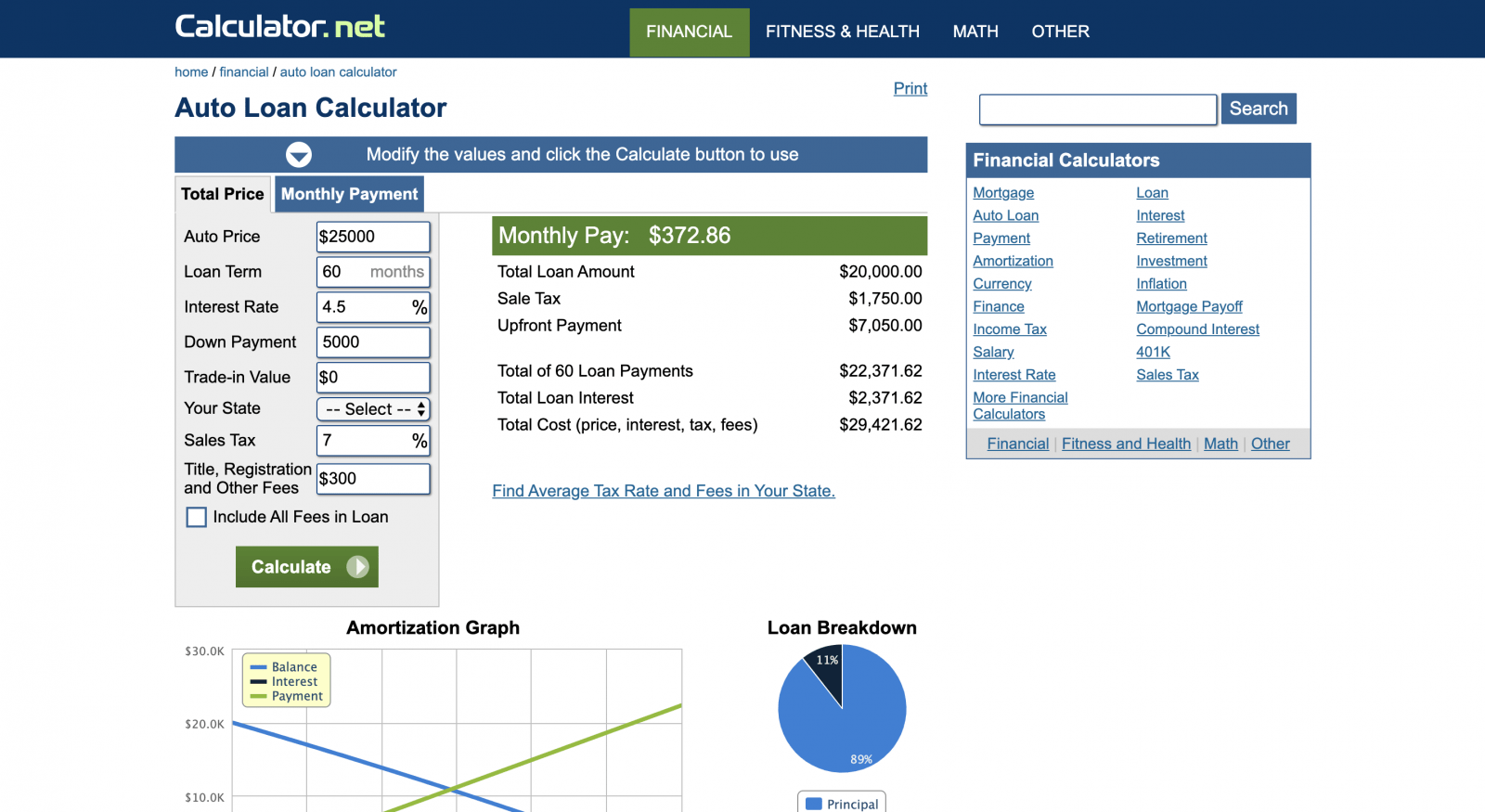

Calculator.net is another website solely dedicated to being one of the best calculation machines on the internet. It has just about every piece of information possible when it comes to buying a car. It takes the price, loan term, interest rate, down payment, trade-in value, state, sales tax, and TTL fees (tax, title, and license) to provide you with a ton of graphics and details. While it's not the most visually appealing website, it offers an amortization chart and graph as well as a pie chart breaking down the principle and the interest. In other words, Calculator.net is sure to teach you a thing or two!

This website takes a lot of the hidden fees into consideration. Often TTL is not something we think about when buying a car, but it's those little fees that add up to be more than we can handle. Calculator.net has got you covered.

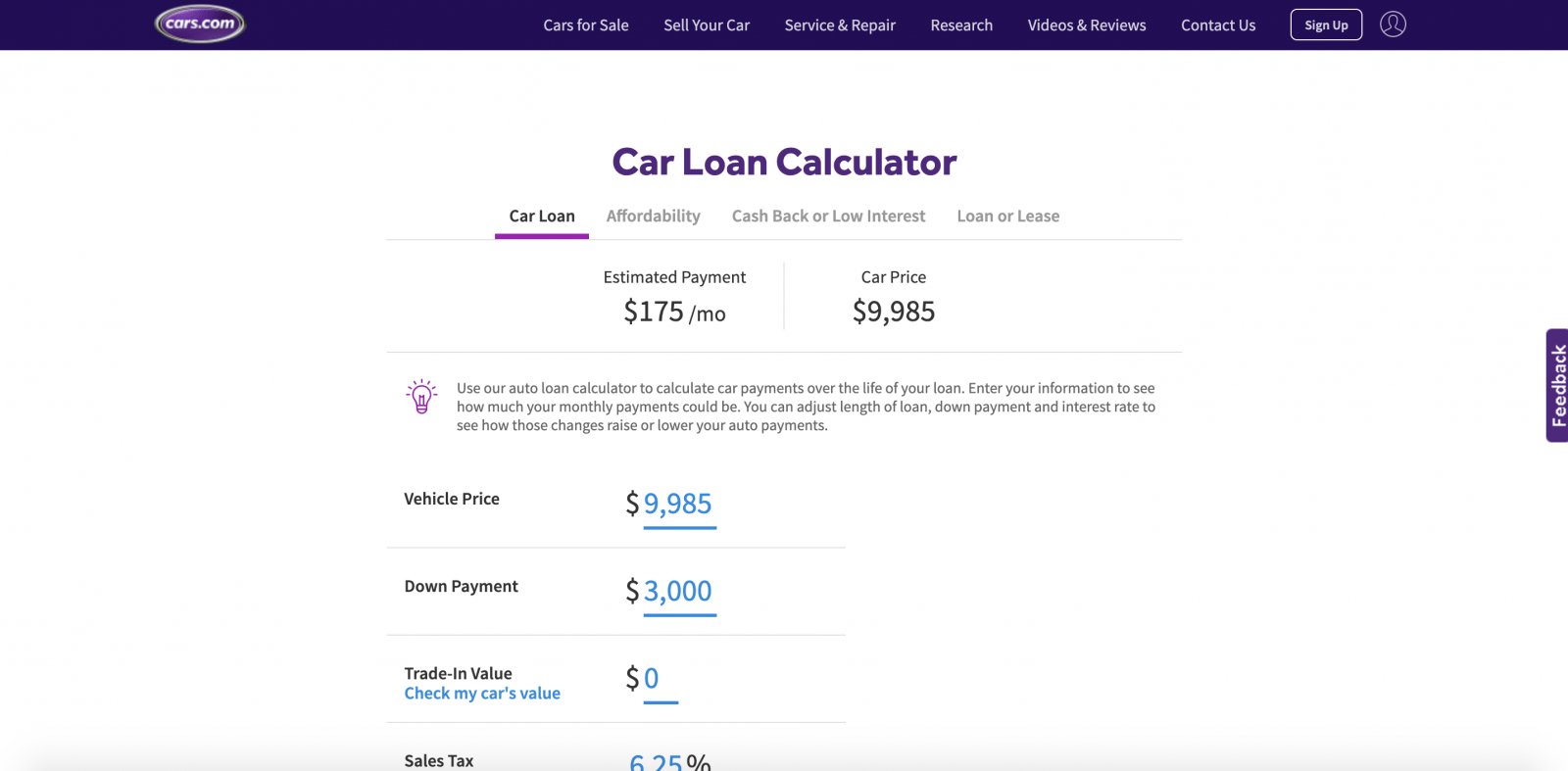

Bankrate

Bankrate has one of the most visually appealing auto loan calculators, as well as provides a competitive amount of information on par with the other auto loan calculators mentioned. They give the option to see amortization schedules for your entered info, which is a great addition. They also provide up-to-date APR percentages. That is something not everyone does. This helps them stand out as a fantastic resource for determining what an accurate monthly payment will look like in today's market.

There is also an option to compare auto loans from multiple local sources, which can be wildly convenient in helping you decide where to go to finance a car. All of these work together to create an intuitive service people love to use.

Are Car Payment Calculators Accurate?

In simple terms: it depends. A lot of car loan calculators can be as accurate as you make them. In other words, the more accurate the information you put in, the more accurate the information you get out. Watch out for calculators tare too simple. If it only shows 3 or 4 variables, chances are you will get a more broad, estimated payment. However, if the calculator is able to take into consideration an accurate APR, the sales tax, and other smaller variables such as the title and license fee, then it will be reasonably close to what you will see at the dealership.

How Much Should I Put Down As A Down Payment On A Car?

Down payments are always a good idea. You should put down as much as you can afford to. The more you put down on a car, the less you will pay in interest when the car is finally paid off. This works the same way when you take a loan for a house. Generally, it is common to try and put down 20% when you purchase a home. It might be easy to assume the same for a car, but that is not necessarily the case. Making this distinction is important because a vehicle is a depreciating asset.

That's why putting down as much as you can, in the beginning, will save you money in the long run. The more you put down, the less you will pay in interest for your depreciating asset. You might as well save as much money as you can by putting down as much as you can afford.

What Is The Interest Rate On A Car Loan?

Interest rates (APR, annual percentage rate) on car loans vary. If your credit score is excellent, you're going to get a better interest rate than someone who has a bad credit score. Rates also fluctuate in the market. In January of 2015, the average rate was around 4%. In December of 2018, it was at almost 5%.

Just because you have a great credit score does not mean you will get the rate your friend got last year with the same credit score. A one or even two percent difference probably won't stop anyone from buying a car if they need or want one bad enough, so just do your research and make sure you can afford what the current APR is at. Plenty of the car loan calculators mentioned above can help figure this out.

Summary

Car loan calculators can be valuable tools in determining what kind of car you can afford to buy. Don't let the dealerships intimidate you with all the numbers and rates. With a couple of clicks from this article and an auto loan calculator, you can access all the information you need to make an educated purchase and drive off the lot in a vehicle that makes you and your wallet smile.

Questions on financing versus car loans? Check out this article.

How long should your car loan be? Here's the answer.