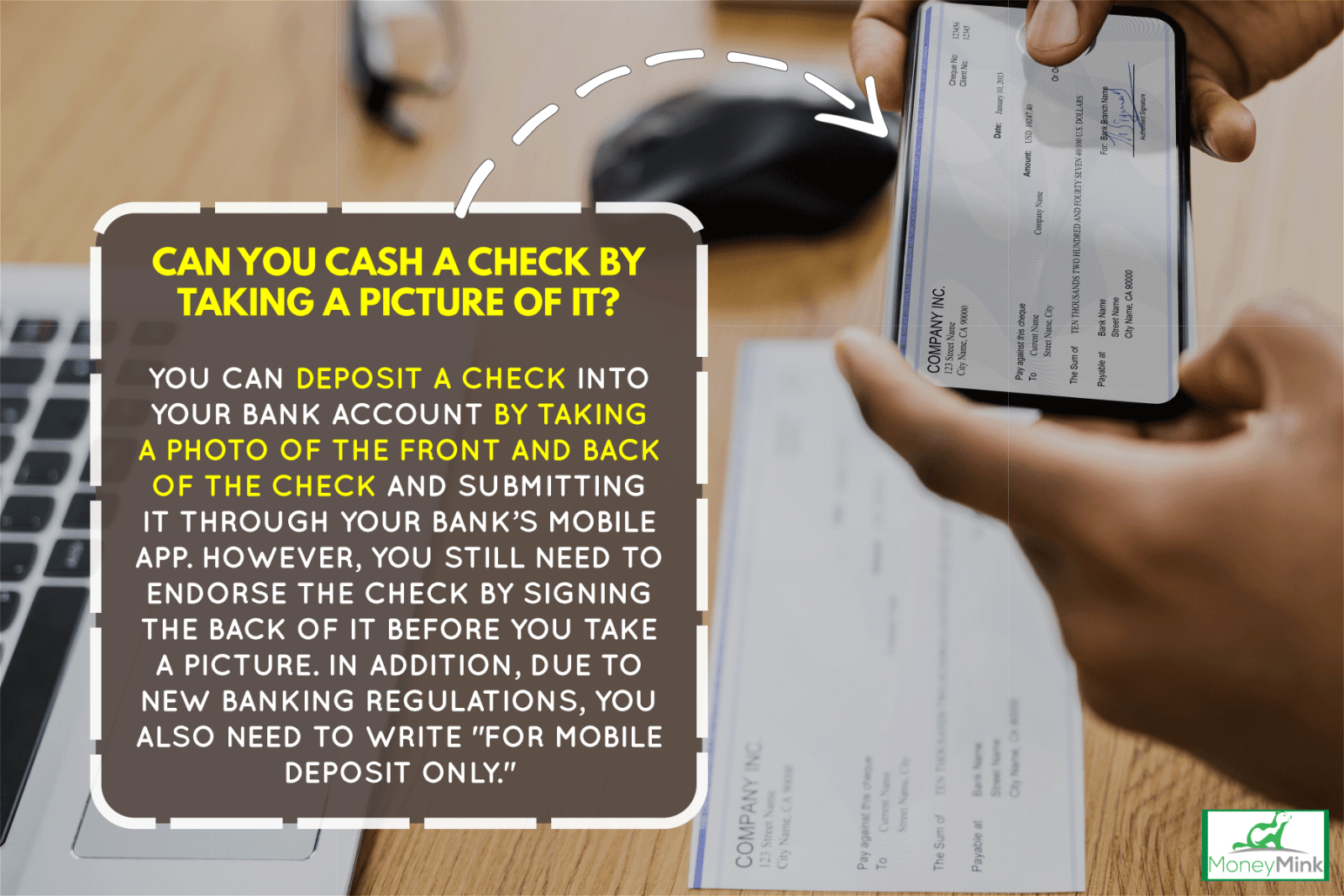

In the past, in order to cash or deposit a check, customers had to visit a physical bank branch during business hours. But with mobile banking, can you cash a check by just taking a picture of it? Let's take a look to see if this is an option.

You can deposit a check into your bank account by taking a photo of the front and back of the check and submitting it through your bank’s mobile app. However, you still need to endorse the check by signing the back of it before you take a picture. In addition, due to new banking regulations, you also need to write "For Mobile Deposit Only."

By knowing how to use mobile check deposits, you can save time and effort by not having to go to the bank every time you need to deposit a check. In this article, we will dive deeper into how to deposit a check using your smartphone. In addition, we will answer other questions about checks and mobile banking, so read on!

How Do You Deposit A Check Using Your Smartphone?

With technology and innovation always improving, it has become easier to do our banking tasks without having to visit a physical bank branch. One of the ways banks have made this possible is by allowing their customers to deposit checks using their smartphones.

For example, if your employer or someone you know wrote you a check, you can take a picture of the front and back of the check and deposit it into your checking account using your bank’s mobile app.

Obviously, you will need to have an active bank account and have the bank’s mobile app downloaded onto your smartphone. In addition, you will need to endorse the check by writing “For Mobile Deposit Only” on the back of the check before taking pictures of it.

Steps For Depositing A Check On A Bank Mobile App

To deposit a check using your smartphone, follow these steps:

- First, endorse the check by signing the back of the check. There will be a signature line on the back of the check for you to sign. Use the same signature you used when opening the bank account so the bank can verify it's you signing it.

- Next, underneath the signature, write “For Mobile Deposit Only.” This is a new regulation that banks are required to follow so that people don’t try to deposit the same check more than once. However, some banks have checks that have a box that you can check off instead of writing it out. Either way, be sure not to skip this step, or the check could be rejected.

- Once you have signed and dated the back of the check, take pictures of the front and back of the check using your smartphone. Make sure that all four corners of the check are visible in the picture and that the information on the front and back of the check is legible.

- Lastly, submit pictures of the front and back of the check through your bank’s mobile app to the account in which you want to deposit the check.

And that’s it! You have successfully deposited a check using your smartphone. It’s important to remember that you should never throw away the physical check after you have deposited it. Instead, keep it in a safe place for at least six months in case there are any problems with the deposit.

What Are The Benefits Of Depositing A Check Using Your Smartphone?

There are several benefits of depositing a check using your smartphone. The main benefit is that you can do it without having to go to the bank. This can save you time and effort, especially if the bank is not close to where you live or work.

Another benefit is that it’s more secure than carrying around a physical check. If you lose the physical check, it can be a hassle to have a new check issued.

However, if you have deposited the check using your smartphone, the check is linked to your bank account, so no one else can deposit it. Lastly, if you need to deposit a check but the bank is closed, you can still do it using your smartphone.

How Long Does It Take For A Mobile Check Deposit To Go Through?

Once you have submitted the pictures of the check through your bank’s mobile app, it can take one to two business days for the deposit to go through.

However, some banks will allow you to access the funds from the check immediately after you have deposited it. This is called an “instant deposit” and is a great way to access your funds quickly if you need them.

To find out if your bank offers instant deposits, check the terms and conditions of your account or contact customer service.

However, there may be times that your mobile deposit will be delayed. For example, if it is a holiday weekend and you deposit the check on Friday, it may not go through until Tuesday.

Or, if you submit the pictures of the check after the cutoff time for mobile deposits, it may not go through until the next business day.

To avoid any delays in your deposit, be sure to check with your bank to find out their mobile deposit policy and ensure you are following all the requirements.

Can You Deposit A Screenshot Of The Check?

The screenshot has several benefits, but depositing a check is not one of them. A screenshot cannot be used to deposit a check because it is not an acceptable form of payment.

A photo of the original check needs to be taken using your smartphone. This is because the bank needs to ensure that it isn't a fake check and that all the required information is visible.

So, to be sure that your deposit isn't rejected, be sure to take a photo of the original check and submit it through your bank's mobile app.

Can You Cash An Emailed Check?

Emailed checks are an encrypted form of payment that can be used to pay bills or send money to friends and family. They are considered a secure form of payment and can be cashed or deposited like a paper check.

All you need to do is print out the emailed check and take it to your bank. Of course, you will still need to endorse the check before you can deposit or cash it.

The bank will then verify the check as if it were a physical check, and the funds will be deposited into your account.

This is can be a convenient form of payment if you need to send someone money quickly. If not, it can take some time to mail a physical check.

Can I Cash A Check If I Don't Have A Bank Account?

It's possible to cash a check without a bank account, but it's not always easy. There are several check-cashing services that will cash your check for a fee. However, these services are not always available, and they can be expensive.

Another option is to find someone who has a bank account and is willing to cash the check for you. You will need to sign over the check to them, and they will deposit it into their account and then give you the cash.

Keep in mind that if you go this route, you will need to find someone you trust, as they will have access to your funds.

Lastly, there are some ATMs that will allow you to deposit a check without an account. However, this option is not always available and could also have fees applied.

In this situation, it doesn't hurt to get a bank account so that you can easily deposit and cash your checks.

How Do Banks Verify A Mobile Check?

Banks verify mobile checks the same way they verify physical checks. They will check for the required information such as the date, payee, and amount.

They will also compare the signature on the check to the one on file. Once all of this information has been verified, the bank will deposit the funds into your account.

Of course, if there is any information missing from the check or if the signature doesn't match, the bank will reject the check.

You can check your bank's requirements for a mobile deposit to ensure that your check will be accepted.

Final Thoughts

Overall, mobile check deposits are a quick and easy way to deposit your checks. However, there are a few things you need to keep in mind, such as the requirements of your bank and the type of check you are depositing.

If you follow all the requirements and take the necessary precautions, then you should have no problem depositing your check using your smartphone.

Made it to the end? Here are other articles you might find helpful:

Can You Deposit A Check For Someone Else Into Their Account?